Fringe Benefits Tax

Benefits

EROAD’s Electronic FBT Logbook provides an easy to use solution that minimises FBT payments, as well as time spent by your staff collecting and maintaining the necessary tax records.

Minimise your FBT payments.

Easy to use and accurate recording of vehicle usage for FBT calculations. EROAD’s Electronic FBT Logbook provides an easy to use solution that ensures you’re not paying too much FBT, it is important to remember that the selected period still needs to be indicative.

A fully automated solution makes filing easy.

Automated record keeping for ease of auditing and filing.

Single device.

Delivered on EROAD’s Ehubo, our simple in-cab device, with no additional apps or mobile device management needed.

Accurate and reliable.

EROAD’s FBT solution uses proven technology that is highly accurate, proven and reliable.

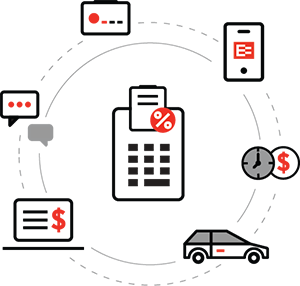

EROAD Solution

Get on top of your FBT obligations quickly and easily with EROAD’s solution.

EROAD’s FBT solution provides:

- Support for calculation of FBT using the operating cost method with EROAD’s Electronic FBT Logbook provides an easy to use solution that ensures you’re not paying too much FBT by your business

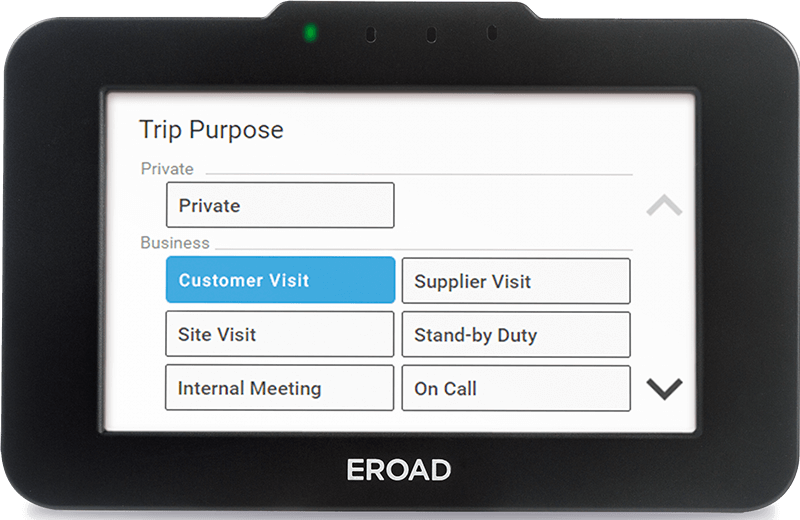

- Easy logbook capture of the type of trip for your drivers, with the drivers entering the type of trip on the Ehubo2.

- Headline metrics to help fleet and operations managers select a representative 12-week period to accurately show the business usage of the vehicles in your fleet and monitor business vs private usage

- Reports that highlight when a driver hasn’t completed the logbook, to improve compliance

- Largely automated record keeping stored for the requisite period

EROAD Solution

Key features include:

- Ability to collect trip purpose from the driver

- Automated collection of other trip details including odometer and date/time from Ehubo2

- High-level metrics from EROAD Depot helps to assist fleet or operations managers, monitor the percentage of business usage, uncategorised trips and helps select the representative reporting period

Recommended Resources

Ten ways EROAD’s Electronic Logbook can save you time and money on your FBT

EROAD's Fringe Benefit Tax solution provides scheduled reports so you can monitor incomplete logbooks, ensure compliance and automated record of it. …

FAQ: Your top FBT questions answered

Confused by the Fringe Benefit Tax? EROAD has your top questions answered online in our FAQs. Let us help you receive the …

Are you paying too much for your fleet’s Fringe Benefits Tax?

Learn how to better manage your fleet costs effectively and minimise your Fringe Benefit Tax (FBT). Visit EROAD now for more information. …

How an Electronic Logbook can drive down your FBT costs

Sick of calculating Fringe Benefit Tax costs? Come online to learn how EROAD's electronic logbook is designed to make FBT calculation much …