Ten ways EROAD can save time and money on your Fuel Tax Credits

Ten ways EROAD can save time and money on your Fuel Tax Credits

Claiming fuel tax credits (FTC) is routine for most Australian businesses operating fleets and off-road equipment – but many are missing out when it comes to maximising their FTC rebates.

This is because most typically use the standard on-road method to calculate their FTC as it is easy and doesn’t require a lot of record-keeping. All you need is your fuel receipts and your accountant does the rest!

If this is your business, you could be leaving thousands of dollars behind in additional FTC rebates you’re entitled to!

Unlock the full FTC rebates you’re entitled to!

- Automate and capture real-time, accurate data for your FTC claim

- Save significant admin time

- Claim 2.5 times the standard on-road FTC rebate rate for off-road usage

- Use technology to recover under-claimed FTC retrospectively for up to FOUR previous years

- Easily claim off-road FTC for light vehicles

- Create ‘geofences’ for work sites near or close to public roads or construction zones to claim the maximum FTC entitlement

Get the maximum FTC rebate you deserve

Did you know that, if your business uses vehicles off-road for travel, idling or operating auxiliary equipment (such as compressors, refrigeration units, farming or hydraulic machinery) you could claim the off-road rate of up to 42.7 cents* per litre for your FTC?

That’s $23.00 more per 100 litres of fuel than the standard on-road rate!

And, despite light vehicles not being entitled to claim on-road FTC, you can claim up to 42.7 cents* per litre if they operate in off-road areas.

That could add up to a significant amount of extra money in rebates for some companies!

*Note: Rates are as at 1 February 2021 – 30 June 2021. FTC rates are reviewed every six months so may differ slightly from those above. The off-road rate also varies depending on fuel type. Please see the Australian Taxation Office for more details here.

Here’s how EROAD’s FTC Solution can help your business thrive:

1. Increase your rebates

Relying on estimates or assumptions are a key reason many businesses under-claim on FTC. With EROAD’s Fuel Tax Credit Solution, you could claim 2.5 times the standard FTC rebate rate. EROAD’s FTC solution allows you to automatically measure and calculate FTC entitlements not only for fuel used on main roads, but also for off-road travel, idle and use of auxiliary equipment, all of which are entitled to the highest FTC rate.

2. Saves significant paper work and admin time

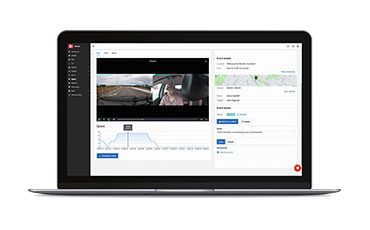

By using GPS tracking for all assets that use fuel, you can capture all real-time data and automate the Fuel Tax Credits (FTC) claim process. No more trawling through disparate data sets, incomplete spreadsheets, receipts or driver logbooks. Using vehicle location data, EROAD’s FTC Solution automatically calculates your FTC rebate and allows you to file more frequently – at the touch of a button. All reports can be downloaded from EROAD’s Depot software and lodged immediately with ATO – saving you crucial time to work on other important tasks.

3. Increase visibility of your fleet usage and FTC

Get the full picture on your FTC claim entitlements as well as exactly what your vehicles are doing out in the field. EROAD’s smart telematics solution accurately tracks your fuel usage, where your vehicles are and how they are being used. It also monitors a range of other driver behaviour, compliance and safety aspects of your fleet which not only delivers a more accurate FTC return, but also a range of other efficiency and productivity insights.

4. Maximise Retrospective claims

Organisations are able to make a retrospective claim of up to four years of fuel tax credits; even if they’ve previously submitted a claim. Using EROAD’s FTC Solution you can review past activity to re-calculate and re-submit the fuel tax credits based off a more accurate and holistic set of considerations.

5. Increased accuracy that gets the maximum claim you’re entitled to

Eliminate the guesswork from manual calculations based on approximations and estimates from sample data or past FTC claims. EROAD’s GPS system accurately tracks your fleet’s every move. EROAD’s intuitive, simple to use FTC Solution draws on real-time analytics to calculate the most accurate and transparent claim for your business. A more accurate claim ensures that your business isn’t missing out on increased rebates it’s entitled to, whilst providing you with the evidence and reassurance you are making a transparent claim.

6. Minimise risk – provides full transparency and auditability

EROAD’s smart telematics technology reduces your tax risk exposure from inaccurate claims as it provides you with solid, accurate evidence to claim the maximum amount your business is entitled to.

7. Accurate claims

A major gap for most organisations when claiming fuel tax credits is the underestimation of claims due to the lack of evidence. As a result, many organisations underclaim their entitled rebate in fear of being unable to validate theirs with the Australian Taxation Office.

EROAD’s FTC Solution provides your organisation with the peace of mind to claim the most accurate and comprehensive rebate. The solution provides industry-leading accuracy, data cleaning and standardisation to ensure the rebate is evidence-based.

8. A more efficient business

Claiming more accurate fuel tax rebates and reducing fuel costs is just one of the great benefits of technology. When an telematics is installed in your vehicles, you can better predict patterns and resolve issues before they arise. The technology provides you with information, such as engine hours completed at job sites and distance travelled. From this information, you know exactly how long new or future jobs will cost you. This makes pitching for new contracts easier as you have visibility and a better understanding of your business’s capabilities.

9. Better decision-making.

EROAD’s smart technology platform provides analytics and information to ensure you base your decisions on accurate information.

10. Geofence special work areas to claim the maximum FTC rebate.

EROAD’s smart telematics software allows you to create a temporary ‘geofence’ or ‘buffer’ zone around a specific work area. This could include anything that may not typically be deemed an ‘off-road’ area – such as a construction site immediately adjacent to, or on, a public road – to deem it a temporary ‘off-road’ work area. This allows companies to then claim the maximum off-road FTC rebate for vehicles and equipment operating in these areas.