FTC Savings

Savings

Maximise Fuel Tax Credit

- With only a 6 months pattern of continuous use you can recover under-claimed rebates back 4 years.

- The data collection is accurate and fully automated making the admin easy.

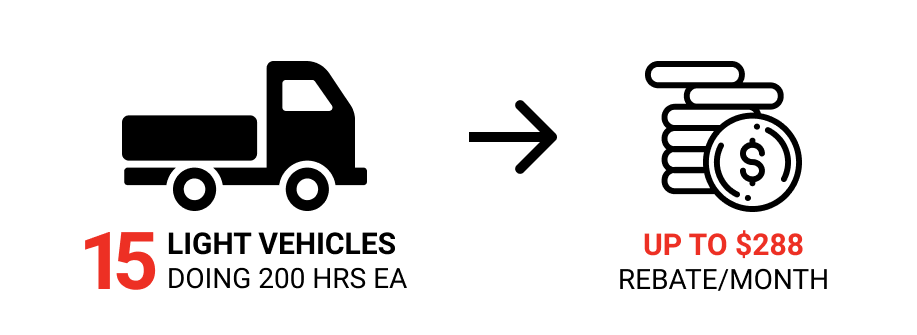

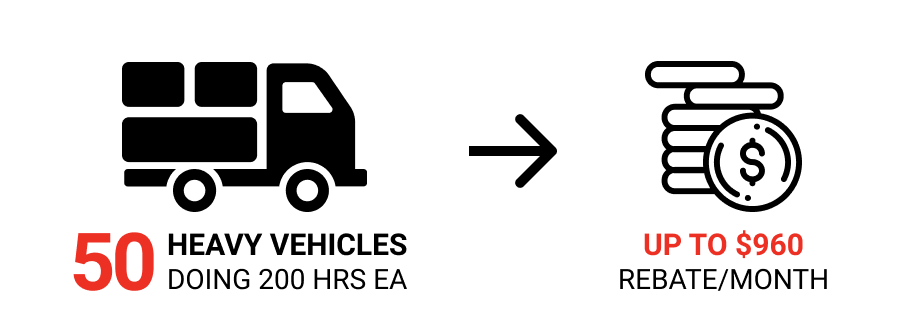

How much could you be claiming?

*example only actual rebates will vary.

FTC Calculator

Name(Optional)

Class

Quantity

Average Monthly Kms

Consumption

Total Monthly Consumption

Use Ratio

Off Road

On Road

Class

Off Road Rebate

($0.427 for All)

On Road Rebate

($0.169 for Heavy)

Total Monthly Rebate

Heavy

Light

Rebate

Heavy

Light

Off Road

$0.427 for All

On Road

$0.169 for Heavy

Monthly Total

These calculations provide general guidance and don’t take into account factors such as Aux usage and Fuel burn rate at idle etc, but get in touch with one of our FTC business managers via the link below and we can help get you a more accurate figure.

Benefits of EROAD FTC

Automatic tax credit calculations

Your companies fuel tax credit total is automatically calculated, based on telematics and fuel consumption information that is already captured by your EROAD solution.

Set auxiliary equipment fuel consumption once only

You only have to set your auxiliary equipment’s fuel consumption rates once and then they will be automatically included in your fuel tax credit calculations.

Claim for idle fuel consumption

The EROAD FTC product has the functionality to support claiming rebates for fuel used in vehicles or equipment idling on or off-road.

Archive historical FTC reports

The product allows snapshots of quarterly fuel tax credit reports, enabling accurate record-keeping to support your claims.