Fuel Tax Credit Rebates

Benefits

Drive incredible benefits into your business.

EROAD takes the hassle out of your FTC calculations and claims and allows your business to unlock every last cent of your FTC rebate entitlement. For some of our customers, this has meant receiving significant one-off, backdated rebates.

Is your business claiming everything you’re entitled to? With EROAD, you can be confident you are.

1. ATO Class Ruling

The Australian Tax Office (ATO) has issued a Class Ruling confirming that the Fuel Tax Credit (FTC) report generated from the EROAD FTC solution (using the Ehubo device) can be used as a record for FTC purposes (see Class Ruling 2021/95).

2. Backdate your FTC claim by up to four years.

That’s right. If you can demonstrate a six-month pattern of consistent use, you can go back four-years to recover under-claimed rebates. That’s up to four years of money you’re owed.

3. Easier, faster, and higher claims.

EROAD allows you to streamline your FTC rebate claims, making it easier, more accurate, and reducing admin time. It also means you can receive the full rebate you’re entitled to. How good is that?

4. Capture vehicle activity to support your rebate claim.

EROAD lets you easily capture vehicle activity to support your off-road claim, for both heavy and light vehicles.

5. Relax.

EROAD’s FTC solution provides peace of mind when doing your FTC rebate claims, as our unique paperless easy to use software is fit for purpose.

6. Claim up to 2.5 times more for off-road than on-road.

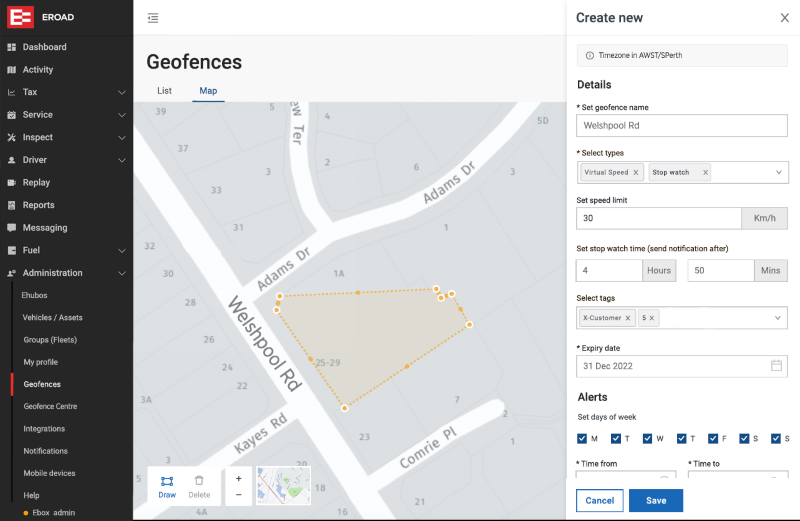

EROAD makes off-road claims easier than ever, by creating geofences where worksites overlap public roads. Does it matter? You can claim 2.5 times more for off-road rebates than on-road, so yes, it matters.

7. Use geofencing to claim your maximum entitlement.

Create geofences to track off-road usage where worksites overlap public roads and claim your maximum FTC entitlement.

8. Claim everything you’re entitled to.

EROAD ensures you can include auxiliary equipment and claim idle time on heavy vehicles so you can claim everything you’re legally entitled to.

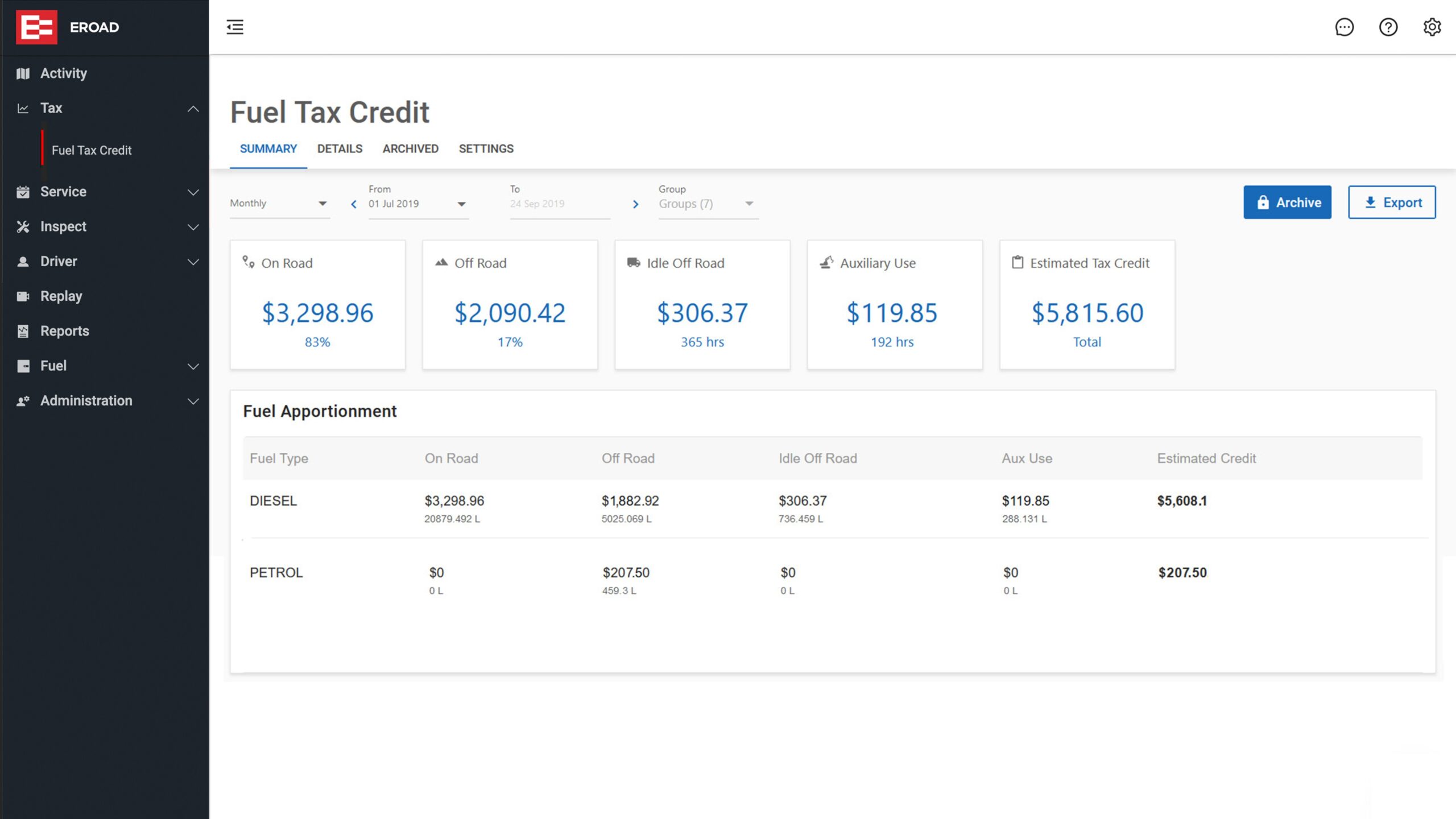

9. Seamless calculations made on accurate data.

Your FTC rebate is automatically calculated, based on accurate telematics information captured by your EROAD solution.

10. Covers your auxiliary equipment, too.

Set your auxiliary equipment’s fuel consumption rate once and they’ll be automatically included in your fuel tax credit calculations.

11. Claim for idle.

EROAD’s FTC solution even lets you claim rebates for fuel used when your heavy vehicles idle.

12. Become your accountant’s best mate with accurate, archivable records and reports.

With snapshots of your FTC reporting periods, your business gains accurate records for reference, for your accountant to work with.

“The most exciting outcome from using the EROAD Fuel Tax Credit solution, was the recovery of under claimed rebates, it was a great bonus to receive, $1310.00 AUD per vehicle in fuel tax credit rebates.”

Zoe Moulton, Co-director, Pingelly Transport

EROAD can save time and money on your Fuel Tax Credits (FTC)

Claiming fuel tax credits (FTC) is routine for most Australian businesses operating fleets and off-road equipment – but many are missing out when it comes to maximising their FTC rebates.

Find out how EROAD’s FTC Solution can help your business thrive.

EROAD Solution

EROAD made an FTC solution that works, so now you don’t have to.

EROAD’s FTC solution means your business can claim rebates on all of the fuel tax you’ve paid, for vehicles, whether it’s on or off road.

EROAD’s FTC solution allows your business to maximise the rebates you’re entitled to, even when fuel tax credit rates change. With EROAD, your credits are seamlessly calculated and reported for your business activity statements, meaning increased accuracy, reduced admin, and a much easier process overall.

If you can show six-month pattern of consistent use by telematics, you can claim fuel tax credits for the last four years. For some of our customers, this has meant receiving significant one-off, backdated rebates.

Quality data

Commercial vehicles, on or off-road. EROAD’s got you covered.

EROAD’s real time* vehicle location monitoring means trucks log off-road use automatically, the moment a vehicle enters a private road. You can even set simple geofencing boundaries for temporary work sites.

Claiming rebates for heavy or light vehicles has never been easier. Light vehicles can also take advantage of EROAD’s FTC simplicity, accruing fuel tax credits when off-road.

*EROAD uses High Frequency Polling which produces a location event, or “ping,” every 250m or where a significant event occurs, such as turning, vehicle statistics, ignitions, and stops. Latency events may impact on this.

EROAD Solution

Quality data to help you make good business decisions.

With EROAD, you’ll gain access to a comprehensive resource of easy to use data about your fleet and your business that you previously might not have been able to see.

This data will help you, your drivers, and other staff make better decisions in the running of your business for increased safety and efficiency.

Recommended Resources

How to calculate your Fuel Tax Credits (FTC) rebates

Calculating FTC for your fleet depends on a range of factors. Don't make it hard for yourself. Let EROAD do it for …

How geofencing helps maximise your FTC rebates

EROAD's telematics can help you maximise your Fuel Tax Credits rebates through geofencing work sites and increasing off-road scenarios. …

Making FTC easy for the mining and gas industry

By Exploring and Prospecting for Minerals. Removing Mining Waste from a mine site. Rehabilitation of a place affected by a mining operation. …