What’s the best method to save time and money on your fleet’s FBT?

What’s the best method to save time and money on your fleet’s FBT?

Providing employees with a company vehicle is now common in Australia – but are you paying too much FBT?

With so many changes to the FBT laws over the last five years, have you stopped to evaluate which operating method is now right for you?

What is vehicle FBT?

If your business provides work vehicles to employees for private use – whether it’s cars, vans, 4WDs, utes, any goods-carrying vehicle that has a cargo capacity of less than one tonne, or a passenger vehicle that can carry up to eight people – then it is liable for Fringe Benefits Tax (FBT).

The taxable value of a car fringe benefit is designed to reflect an employee’s ‘private use’ of the vehicle, as only the private use of the car is subject to FBT. Additionally, the FBT law allows ‘employee contributions’ to reduce the taxable value of the car’s Fringe Benefits Tax.

How to calculate FBT

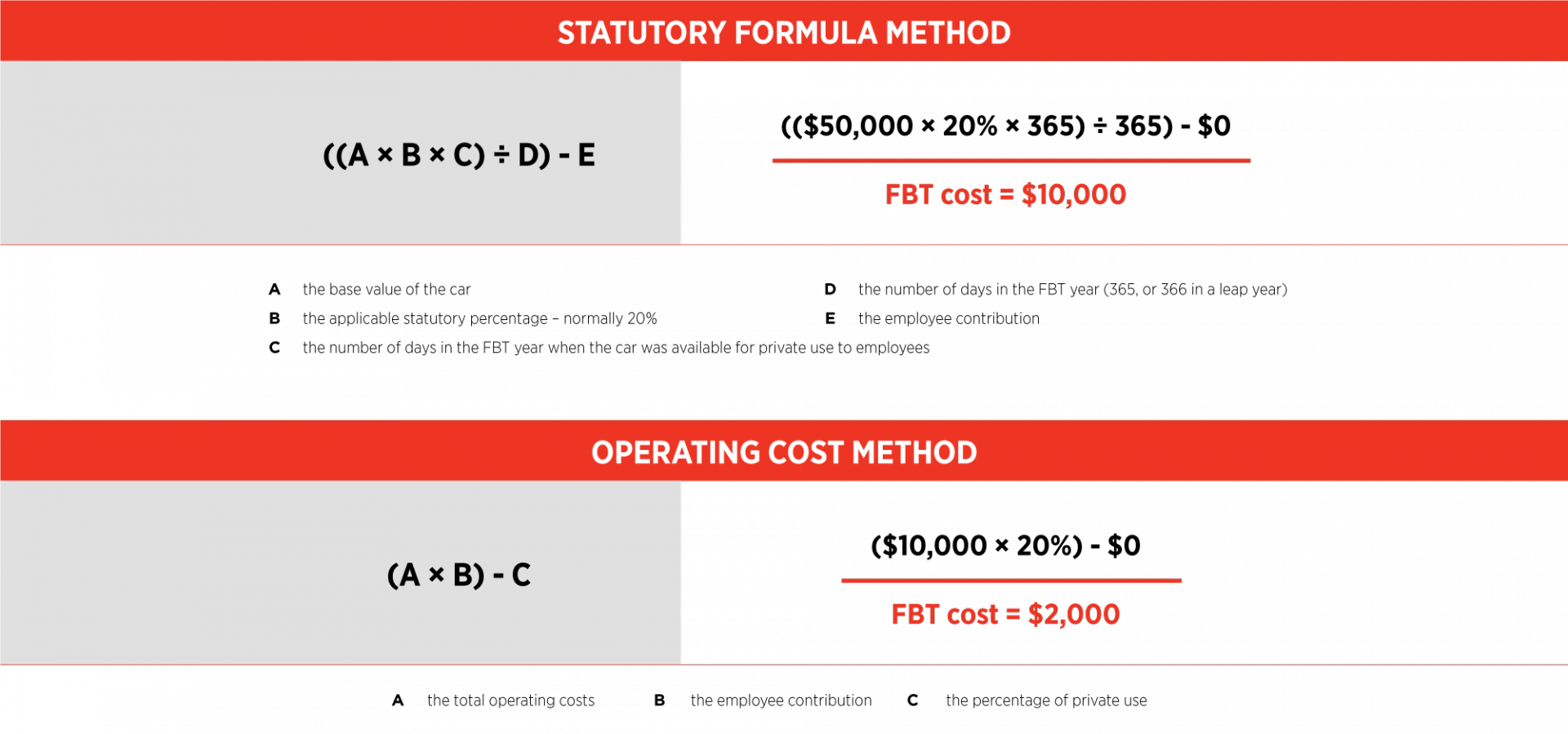

There are two ways to calculate Fringe Benefits Tax for motor vehicles:

- The statutory formula method, which is based on the car’s cost price.

- The operating cost method, which is based on the costs of operating the car.

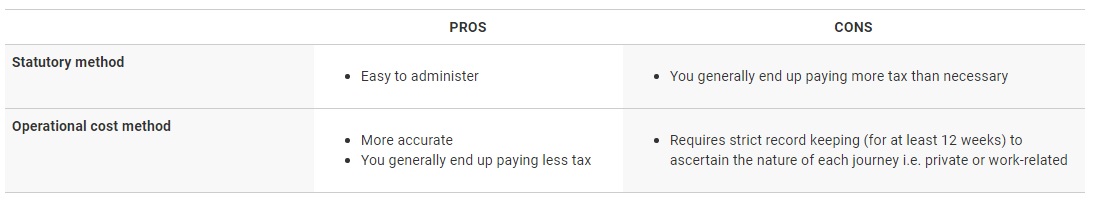

Typically most businesses have used the statutory method to determine their FBT as it is easier to calculate and doesn’t rely on the onerous task of drivers keeping detailed logbooks.

But with the gradual introduction of a flat FBT rate of 20% (in 2011) some businesses could unwittingly be paying too much.

Telematics can save time and money on your FBT

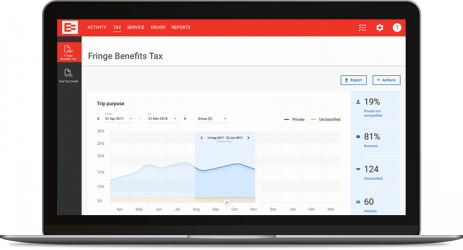

Thankfully, with technology such as EROAD’s electronic FBT logbook, it’s now easier to collect the right data to comply with the Australian Taxation Office’s (ATO) requirements under the operating cost method. This could not only save you significant time and money on your FBT, it could also help run your business more efficiently.

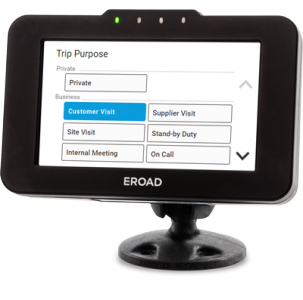

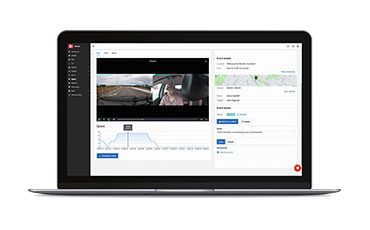

EROAD’s cloud-based telematics platform provides businesses with analytics for a safer, more efficient and compliant business. In addition, it also provides businesses with an in-cab electronic FBT Logbook solution that collects real-time vehicle data at the same time.

In effect, it automates the entire logbook process to record time, data, mileage and the nature of the trip at the touch of a button – saving significant time and money. No more filling in paper logbooks and hours of admin!

More on EROAD’s solution later – first let’s explore how your fleet’s FBT can be calculated.

The Statutory FBT method

The statutory formula method has traditionally been more popular with business owners because it is a straightforward way of calculating your vehicle FBT. A flat rate of 20% of the car’s base value is used, which takes into account the number of days a year the vehicle is available for private use.

Put simply, the base value is the car’s purchase price, less stamp duty and any registration costs incurred as part of the purchase. The number of days available for private use is also taken into account. So if a car was not provided to the employee for the full year, the taxable value is reduced accordingly.

The statutory FBT method is based on how much the vehicle costs instead of how often the vehicle is being used. This means you could be paying tax even when it’s sitting in your employee’s garage. In other words, you could be paying significantly more in fleet FBT than you should be.

The Operating Cost FBT method

The operating cost method is also commonly referred to as the ‘logbook method’ as it requires a business to use logbooks to record how much each vehicle is used for work purposes and how much for private use.

A logbook needs to be maintained for a period of 12 consecutive weeks for each vehicle. It also needs to capture the following detail:

- The purpose of each trip undertaken in the vehicle

- The number of kilometres travelled during each trip

- If the trip was work-related or private

A logbook is then valid for five years, provided there’s no meaningful change in the business pattern of use.

If you are using paper-based logbooks, this can quickly become an administrative nightmare, which is the reason many businesses opt for the easier, yet more costly, statutory FBT method. However, with technology advances, such as EROAD’s electronic FBT Logbook, capturing journey data is now extremely simple.

The advantage of the operating cost method is that it provides for a lower taxable value when employees use their cars regularly for work purposes i.e. when they use the car a lot more for work than privately, you pay less in fleet FBT.

Key things to note about the Operating Cost Method:

- The rules regarding the use of electronic logbooks vary across each region of Australia. In many states, the law requires you to obtain consent from employees well before they get in a car that has a GPS tracking system. In other states, the law does not permit vehicle tracking while an employee is not at work.

Therefore, it’s vitally important to ensure that, before your company starts using an Electronic FBT Logbook, you are fully aware of the key legal requirements in your jurisdiction area. At a minimum, we recommend that your organisation has a clear policy around tracking vehicle usage, taking into account your employees’ right to privacy when undertaking private trips. - Employee’s travelling to and from home is not classified as a work-related trip and needs to be recorded as ‘private use’ in most cases.

Electronic logbooks help save tax dollars

In effect, EROADs electronic logbook, which is ATO compliant, automates the entire logbook process. It records the mileage and nature of the trip at the touch of a button – which saves significant time and money.

No more filling in paper logbooks and hours of admin!

One of the key benefits of using an electronic logbook, aside from potentially saving time and money on your FBT, is that it can also help run your business more efficiently.

How technology can help save on your FBT costs

The advantage of the operating cost method is that it has a lower taxable value if the car is used predominately for work. This means if they use the car a lot more for work than privately, you pay less in FBT.

Understandably, using paper-based logbooks can quickly become an administrative nightmare. However, with technology advances, such as EROAD’s electronic FBT Logbook, capturing journey data is now extremely simple and could save you a significant amount of money.