FAQ: Everything you need to know to maximise your FTC rebates

FAQ: Everything you need to know to maximise your FTC rebates

If your business uses vehicles or fuel-operated equipment on or off-road in Australia, you’re entitled to claim rebates on some, or all, of the fuel tax you have paid.

Most Australian businesses that operate vehicle fleets and equipment claim Fuel Tax Credits (FTC). But what many don’t do is get the maximum rebate they’re entitled to. This is because they use the standard on-road FTC rate, regardless of whether the fuel was used on public roads or off-road.

This is typically because it’s the easiest method to calculate and doesn’t require a lot of record-keeping. All you need is your fuel receipts and your accountant does the rest.

If this is your business, you could be leaving thousands of dollars on the table in additional FTC rebates!

Here’s everything you need to know about maximising your FTC rebates

What are Fuel Tax Credits?

Fuel tax credits provide businesses with a credit for the fuel tax (excise or customs duty) paid at the pump to run:

- Heavy vehicles

- Light vehicles

- Operating machinery

- Plant and equipment

FTC applies to any business that uses fuel and meets the criteria, with the exception of aircraft, light vehicle travel on public roads and personal use of fleet vehicles.

Excise is paid at the pump and then refunded to businesses by the ATO via BAS.

What vehicles can you claim FTC on?

Businesses can claim FTC on heavy vehicles travelling on public roads and also off-road for vehicles or equipment using on diesel, petrol and some blended fuels for the following activities:

- Light vehicles travelling or idling off public roads or on private property

- Heavy vehicles travelling or idling off public roads or on private property

- The use of auxiliary equipment i.e. concrete trucks, compressors, air conditioning, refrigeration units etc

What is the difference between on-road and off-road FTC claims?

But most businesses only use the standard on-road FTC rate of 16.9 cents per litre of fuel, regardless of whether the fuel was used on public roads or off-road.

If your business uses vehicles off-road for travel, idling or operating auxiliary equipment (such as compressors, refrigeration units, farming or hydraulic machinery) you could claim the off-road rate of up to 42.7 cents* per litre for your FTC?

That’s approximately $23.00 than the standard on-road rate!

And, despite light vehicles not being entitled to claim on-road FTC, you can claim up to 42.7 cents* per litre if they operate in off-road areas.

That could add up to a significant amount of extra money in rebates for some companies!

*Note: Rates are as at 1 February 2021 – 30 June 2021. FTC rates are reviewed every six months so may differ slightly from those above. The off-road rate also varies depending on fuel type.

How is ‘off-road’ defined?

Off-road is defined as any property located at least 30 metres from the centre line of a public road and can include any of the following:

- Truck stop

- Vehicle depot

- Farm

- Mining site

- Quarry

- Logging site

- Construction site

- Loading dock

- Private road

- Council refuse site

How do you calculate FTC?

The amount of FTC you can claim depends on when the fuel was purchased, what sort of fuel it was and how it was used i.e. whether it was on a public road or off-road such as at a depot, farm etc.

It’s also very common for some vehicles to use a tank of fuel on a combination of off-road and public road activities – so it needs to be documented and divided up between the different FTC rates.

Fuel tax credit rates also change regularly, but currently range from 4.2 cents to 42.7 cents* per litre for off-road.

Some fuels and activities are also not eligible for FTC – such as the fuel used on a public road for light vehicles (less than 4.5 tonnes gross vehicle mass (GVM)) or liquefied natural gas.

The higher rate of fuel tax credits (currently up to 42.7 cents per litre*) can be claimed from the Australian Tax Office (ATO) whenever your vehicles or equipment are idling, driving or operating ‘off’ a public road.

While claiming FTC is optional, accurately documenting how and where you use your fuel means that you can recover the maximum rebate you’re entitled to – which can then be put back into running your business.

How can technology help maximise my FTC rebates?

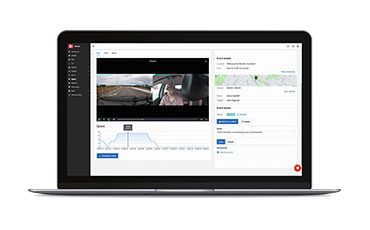

Telematics technology, such as EROAD’s Fuel Tax Credit Solution, easily helps you demonstrate a consistent business pattern of use with GPS technology to unlock under-claimed historical FTC rebates. You can review past activity to re-calculate and re-submit the fuel tax credits based off a more accurate and holistic set of considerations.

In effect, it automates the entire FTC claims process for you which provides significant benefits to your business:

- It takes the guesswork out of your FTC claims as it records the location of every litre of fuel used on-road but also for off-road travel, idle and auxiliary equipment – all of which are entitled to the highest FTC rate.

- It then automatically calculates your FTC – saving you significant admin time at the same time as maximising your claim

- It can also help you prove a current six-month pattern of use for your vehicles which will enable you to then claim retrospectively for under-claimed FTC for the previous four years.

How can technology help maximise my FTC rebates?

Telematics technology, such as EROAD’s Fuel Tax Credit Solution, easily helps you demonstrate a consistent business pattern of use with GPS technology to unlock under-claimed historical FTC rebates. You can review past activity to re-calculate and re-submit the fuel tax credits based off a more accurate and holistic set of considerations.

In effect, it automates the entire FTC claims process for you which provides significant benefits to your business:

- It takes the guesswork out of your FTC claims as it records the location of every litre of fuel used on-road but also for off-road travel, idle and auxiliary equipment – all of which are entitled to the highest FTC rate.

- It then automatically calculates your FTC – saving you significant admin time at the same time as maximising your claim

- It can also help you prove a current six-month pattern of use for your vehicles which will enable you to then claim retrospectively for under-claimed FTC for the previous four years.

What is Geofencing?

The nature of work performed by some industries, such as construction or local government, requires them to sometimes work on or close to a public road – i.e. a waste-water tunnel replacement or the construction of a new over-bridge. In addition, some depots are flush or closer than 30 metres from the centre line.

In these cases, EROAD’s smart telematics software allows you to create a temporary ‘geofence’ or ‘buffer’ zone around that area in order that may not typically be deemed an ‘off-road’ area – such as a construction site immediately adjacent or on a public road – to deem it a temporary ‘off-road’ work area.

This allows companies to then claim the maximum off-road FTC rebate for vehicles and equipment operating in these areas.

Retrospective off-road FTC claims

Who is eligible to apply for retrospective fuel tax credit refunds?

Any business that uses fuel off-road in their heavy or light commercial vehicles, equipment or machinery. This includes businesses who have either under-claimed in previous periods at the standard on-road rate or not at all. As long as you can claim a consistent pattern of use for a period of six months, you will be entitled to claim retrospective FTC rebates. EROAD’s FTC Solution, can help capture easily your six-month fuel usage to support your retrospective claim. Talk to us today about how!

What do I need to do to make a retrospective claim?

You will need to know how much fuel you have used, what type of fuel you’ve purchased for each business activity and how much of that was used in off-road activity. If you have not kept records of that over the past four years, that’s ok. EROAD’s smart FTC Manager can capture a consistent pattern of use for six months which can then be used to make a retrospective claim on off-road use for the previous four years.

If my business hasn’t kept any fuel data or claimed FTC at all, can I make a retrospective claim?

Absolutely. EROAD can help you collect usage data for six months to show a consistent pattern of use which can then be used to claim off-road FTC rebates for up to four years previous.

How much can we expect to get back in retrospective claims?

It depends entirely on your business and the nature and amount of off-road fuel usage. However, in our experience, some customer rebates have ranged from thousands to millions of dollars, depending on the size and nature of the business.