How telematics can maximise your FTC rebates

How telematics can maximise your FTC rebates

Despite more than $12 billion being claimed in FTC each year in Australia, it’s believed many businesses are still under-claiming on their FTC rebates.

This is because many are either unaware of their full entitlement or don’t have the necessary resources to capture the right FTC claim information – particularly when it comes to accurately recording off-road business activity. Instead, they just use the average on-road rate which only provides for a ‘minimal’ rebate!

While claiming FTC is optional, accurately documenting how and where you use your fuel means that you can recover the maximum rebate you’re entitled to – which can then be put back into running your business.

Let technology take the FTC driving seat for you!

Thankfully, technology has made significant in-roads to help businesses claim the FTC rebate they are entitled to.

Telematics, such as EROAD’s telematics software, has revolutionised the fleet management business. Not only does it capture accurate data to help businesses operate their fleets safely, more efficiently and productively, it also uses advanced GPS-tracking technology to map real-time locational and fuel usage data (on and off-road) to maximise your FTC returns.

In effect, it automates the entire FTC claims process which provides significant benefits to your business.

EROAD’s FTC technology:

- Takes the guesswork out of your FTC claims as it records the location of every litre of fuel used

- Automatically calculates your FTC – saving you significant admin time at the same time as maximising your claim

- Helps you prove a current six-month pattern of use for your vehicles which will enable you to then claim retrospectively for under-claimed FTC for the previous four years

How telematics works in your FTC favour

EROAD’s telematics solution can automatically track and calculate your FTC entitlements for not only fuel used on-road but also for off-road travel, idle and auxiliary equipment – all of which are entitled to the highest FTC rate.

It’s this kind of innovation that’s helping businesses thrive and achieve significant returns. By tracking fuel use by time, location and purpose, EROAD does the hard work for you, giving you a higher and more accurate FTC rebate, reducing the administration and time involved and improving operational efficiencies.

EROAD’s Fuel Tax Solution can get you on the road to better rebates

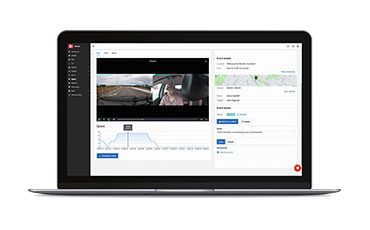

EROAD’s fleet management solution has been designed to provide your business with analytics and insights to help you make better decisions about your fleet as well as maximise your FTC returns.

Simply by installing our advanced GPS tracking devices in your vehicles, you can track all fleet and vehicle activity, location and fuel usage – both on and off the road – at the touch of a button!

What’s more, you can also reduce unnecessary fuel spend and pinpoint inefficiencies.

How EROAD’s FTC Solution works

EROAD’s Fuel Tax Credit Solution allows you to collect, manage and compile the right data to accurately complete, and maximise, your FTC claim.

Here’s how it works:

- EROAD’s GPS tracking hardware is installed in your fleet vehicles.

- If the vehicle has any auxiliary equipment, this is connected directly to the Ehubo (up to 3 connections possible.

- An electronic GPS trail is then created for every vehicle via EROAD’s tracking hardware unit. Data on the vehicle’s performance, activity and location is recorded and classified as either being on a public road or off-road.

- EROAD’s FTC Solution also records other activity such as a vehicle’s ignition being turned on or off, idling and auxiliary equipment being operated off-road.

- The one web-based interface EROAD’s ‘Depot’ allows for easy analysis and custom zones to be created in the system to define on-road and off-road areas for claims. For instance, a construction site on a main road can be ‘geofenced’ as an off-road worksite in order to claim the maximum FTC entitlement.

- Fuel consumption rates are set up based on engine diagnostics, manufacturers specifications or sampling for idling and auxiliary equipment usage – the ‘Safe Harbour’ apportionment method can also be selected.

- Fuel transactions are easily uploaded in the Depot via CSV bulk upload.

- All data for the reporting period are compiled into an easy-to-read report for EROAD’s FTC Solution.

- All data and fuel transactions are securely stored in EROAD’s Depot system alongside an archived record of the claim per reporting period.

- Data can then be easily uploaded to your office financial systems

- You can then collect the maximum monthly FTC rebate you deserve!

Creating ‘Geofences’ or ‘Buffer’ Zones to support your FTC claim

EROAD will automatically calculate off-road either when the vehicle drives on a road which is privately owned, or when the vehicle drives outside the ‘buffer zone’ (or geotunnel) – around 30m from the centre-line.

However, the nature of work performed by some companies, such as construction or local government, requires them to sometimes work on or close to a public road – i.e. a waste-water tunnel replacement or the construction of a new over-bridge. In addition, some depots are flush or closer than 30 metres from the centre line.

In these cases, EROAD’s smart telematics software allows you to create a temporary ‘geofence’ or ‘buffer’ zone around that area in order that may not typically be deemed an ‘off-road’ area – such as a construction site immediately adjacent or on a public road – to deem it a temporary ‘off-road’ work area.

This allows companies to then claim the maximum off-road FTC rebate for vehicles and equipment operating in these areas.