How to calculate FBT for your fleet

How to calculate FBT for your fleet

Get the most accurate information to minimise your FBT claims.

Providing employees with a company vehicle is now very common in Australia and is considered a perk of the job. However, it does come at a cost.

If your business provides work vehicles to employees for private use – then it is liable for Fringe Benefits Tax (FBT). But with so many changes to the FBT laws over the past five years, it’s possible you could now be paying too much just by using your old FBT method.

What is vehicle FBT?

The taxable value of a car fringe benefit is designed to reflect an employee’s ‘private use’ of the vehicle, as only private use is subject to FBT.

A work vehicle is classified as any company car, van, 4WD, ute, goods-carrying vehicle (capacity under one tonne), or a vehicle that can carry up to eight people.

Wich FBT method to choose?

There are two ways to calculate FBT – either with the statutory formula or operating cost method. Most businesses have typically used the statutory method because it’s a straightforward way of calculating vehicle FBT and does not require the driver to keep a detailed logbook.

However, strict new limits on the private use of work vehicles in 2018 could mean you are paying more than you should under the statutory method.

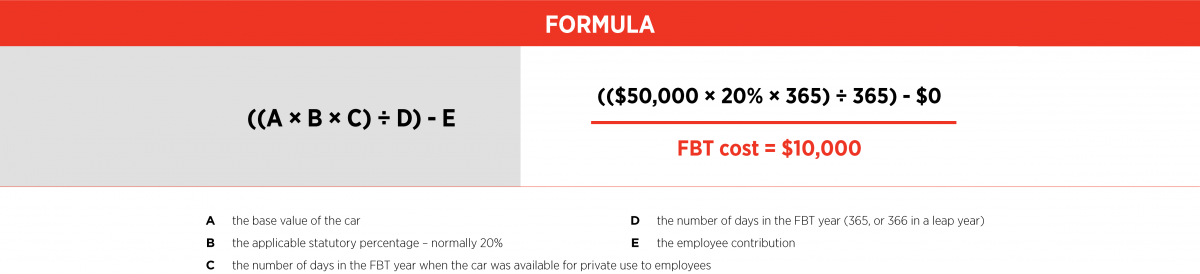

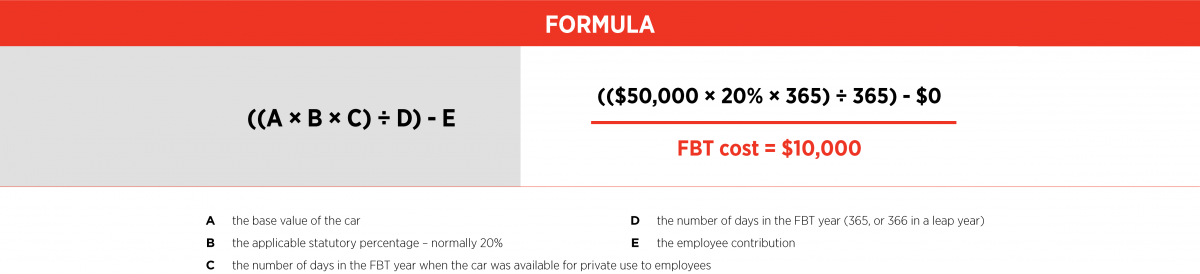

How the Statutory Formula FBT method works

The statutory FBT method is based on how much the vehicle costs rather than how much it is being used privately. It uses a flat rate of 20% of the car’s base value, taking into account the number of days per year the vehicle is available for private use.

Put simply, the base value is the car’s purchase price, less stamp duty and any registration costs incurred as part of the purchase.

The number of days available for private use is also taken into account. So if a car was not provided to the employee for the full year, the taxable value is reduced.

However, the downside of the statutory formula is that you could be paying tax on the vehicle even when it is parked in an employee’s garage.

How the Operating Cost FBT method works

The operating cost method is also commonly referred to as the ‘logbook method’. It requires a business to use logbooks to record how much each vehicle is used for work and private use.

Until now, keeping a logbook has always been seen as a laborious task and why many have opted to use the statutory method. However, thanks to advances in technology, such as EROAD’s electronic FBT Logbook, it is now a simple process that provides a more accurate calculation.

A key advantage of this method is that it provides for a lower taxable value when employees use their cars regularly for work purposes. This means if they use the car more for work than privately, you pay less in fleet FBT. A logbook must be maintained for a period of 12 consecutive weeks for each vehicle and detail:

- The purpose of each trip

- How many kilometres were travelled during each trip

- Whether the journey was work-related or private

The logbook is then valid for the next five years, provided there is no meaningful change in the business pattern of use.

A vehicle’s private use is calculated by assessing the number of private kilometres travelled divided by the total number of kilometres recorded in the logbook. This could either be by paper or electronic over a three month period.

To calculate tax, the car’s private use percentage (as above) is then multiplied by the car’s actual running costs (fuel, registration, insurance, repairs and maintenance*) as well as things like leasing costs, depreciation and interest costs for the year.

Important things to note about the Operating Cost Method:

- An employee’s travel to and from home generally doesn’t constitute a work-related trip and would need to be recorded as ‘private use’ in most cases.

Which FBT method to choose?

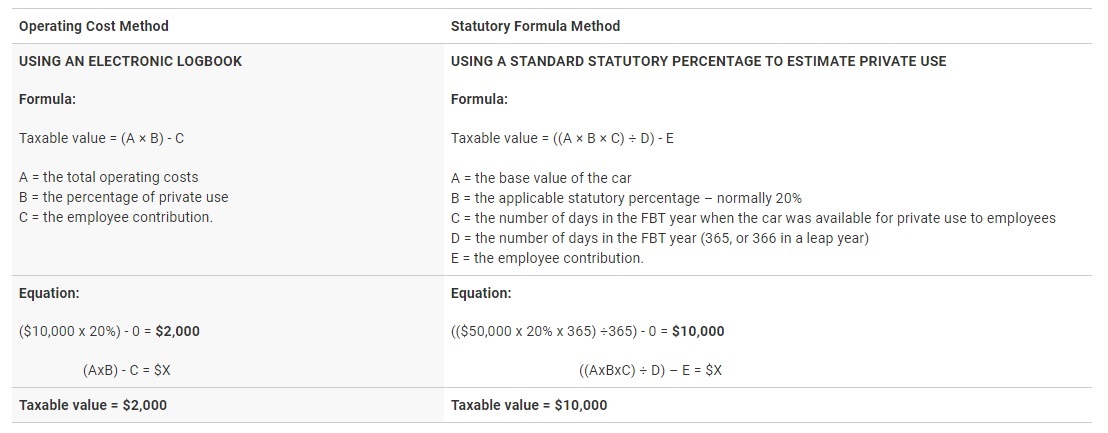

Check out this comparison of the two FBT methods. It is based on a $50,000 vehicle being used privately 20% of the time, with annual operating costs of $10,000.

The above table shows a potential saving of $8,000 simply by using the operating cost method.

*Note – outcomes may vary depending on a company’s individual situation*.

Using paper logbooks can quickly become an administrative nightmare, which is the reason many businesses have traditionally opted for the easier, yet more costly, statutory FBT method. But this means you could be leaving money on the table.

But thanks to technology advances, such as EROAD’s electronic FBT Logbook, capturing journey data is now extremely simple.

EROAD’s electronic FBT Logbook automates the entire logbook process. It records time, data, mileage and the nature of the trip at the touch of a button – saving significant time and money. No more filling in paper logbooks and hours of admin!

Calculating your FBT – a snapshot

- Strict new rules regarding the private use of work vehicles mean you could be paying too much FBT using the statutory formula method.

- Clearly establishing the split between work and private use over any three-month period helps minimise your FBT liability.

- The use of an electronic logbook makes it simple to use the operating cost method for your FBT. It can potentially lower your costs and also help you run your business more efficiently using analytics.