EROAD receives ATO Class Ruling for its Fuel Tax Credits solution

EROAD receives ATO Class Ruling for its Fuel Tax Credits solution

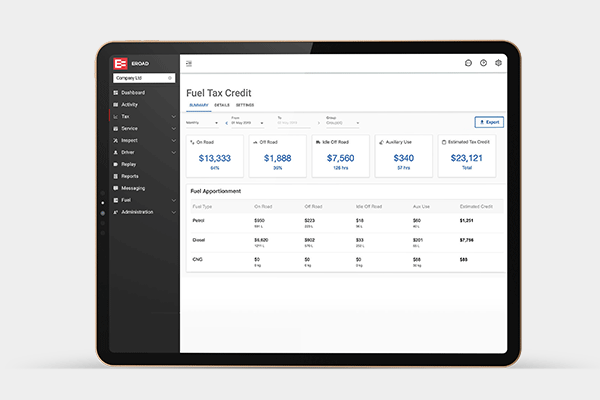

14 December 2021 – The Australian Tax Office (ATO) have issued a Class Ruling confirming that the Fuel Tax Credit (FTC) Report generated from the EROAD FTC Solution(using the Ehubo device) can be used as a record for FTC purposes.

“Having a GPS-based telematics solution that is covered by an ATO class ruling, provides peace of mind that your FTC reports are correct,” said Konrad Stempniak, General Manager, EROAD Australia.

“With the activity data that we capture through our telematics platform, we enable our customers to not only claim fuel tax for the on-road travel for their heavy vehicles, but also for their auxiliary equipment, the idle off-road for heavy vehicles, and for their light vehicles such as utilities,” said Stempniak.

EROAD’s FTC Solution automates the entire FTC claims process which provides significant benefits to a business:

- It takes the guesswork out of your FTC claims as it records the location of every litre of fuel used

- It automatically calculates your FTC, saving you significant admin time at the same time as maximising your claim

- It can also help you prove a current six-month pattern of use for your vehicles which will enable you to then claim retrospectively for under-claimed FTC for the previous four years

By automating the rebate process, your fuel tax credits will be automatically calculated and reported for your business activity statements, reducing admin time and making the rebate process easier.

With EROAD, you have the data to confidently make an FTC claim for the entire rebate amount you are entitled to.

For more information on EROAD’s FTC solution and how you can automate the data collection to help maximise and streamline your FTC claims, go to https://www.eroad.com.au/benefits/fuel-tax-credits/